Posted by Afif Sarwar | Last Updated: December 15, 2025

Executive Summary

- The Experiment: We spent $5,000 promoting a $27 marketing e-book to answer one question: Is “cheap traffic” actually profitable?

- The Split: $2,500 budget allocated to Zone 2 (Poland, Malaysia) vs. $2,500 to Zone 3 (Brazil, Nigeria).

- The Result: Zone 3 generated 5x more traffic, but Zone 2 generated 46% more profit.

- The Insight: Low CPMs in emerging markets are often negated by Payment Friction (declined cards) and lower purchasing power.

- The Verdict: Zone 2 is the “Efficiency Sweet Spot” for standard setups. Zone 3 requires localized infrastructure to unlock.

Table of Contents

The “Cheap Traffic” Trap

If you read our Global Ad Cost Index 2026, you know the math looks irresistible.

On paper, Nigeria looks like a goldmine. You can buy 22 clicks in Lagos for the price of 1 click in New York. Marketers often look at this arbitrage gap and assume it equals automatic profit. We wanted to test that assumption. We launched a live campaign for a $27 digital product (The Cyanide MarTech Handbook) to see if the “Volume Strategy” (Tier 3) could beat the “Efficiency Strategy” (Tier 2).

The Experiment Setup

To ensure scientific validity, we kept the creative and funnel identical.

- Product: $27.00 PDF Guide (No upsells).

- Funnel: Facebook Ad -> VSL Landing Page -> Stripe Checkout.

- Ad Creative: “Ugly” UGC-style video (proven to work globally).

- Budget: $5,000 total ($2,500 per Zone).

The Geographic Split:

- Zone 2 (The Efficiency Frontier): Poland, Portugal, Malaysia, UAE.

- Zone 3 (The Volume Engines): Brazil, Nigeria, Indonesia, Philippines.

Round 1: The Vanity Metrics (Zone 3 Wins)

If you report to a boss who cares about “Traffic” or “Clicks,” Zone 3 is the undisputed champion. The sheer volume of attention available in LATAM and SEA is staggering.

Zone 3 Performance Data:

The Feeling: For the first 48 hours, it felt like we had hacked the system. Our dashboard was flooded with 1,000+ visitors per hour. We were paying pennies for attention that costs dollars in the US. But then we looked at the bank account.

Round 2: The Reality Check (Zone 2 Wins)

While Zone 3 was flooding our server with traffic, Zone 2 was quietly swiping credit cards.

Zone 2 Performance Data:

The Comparison: Zone 2 traffic was 500% more expensive than Zone 3 traffic. Logic suggests it should be less profitable.

The Financial Result:

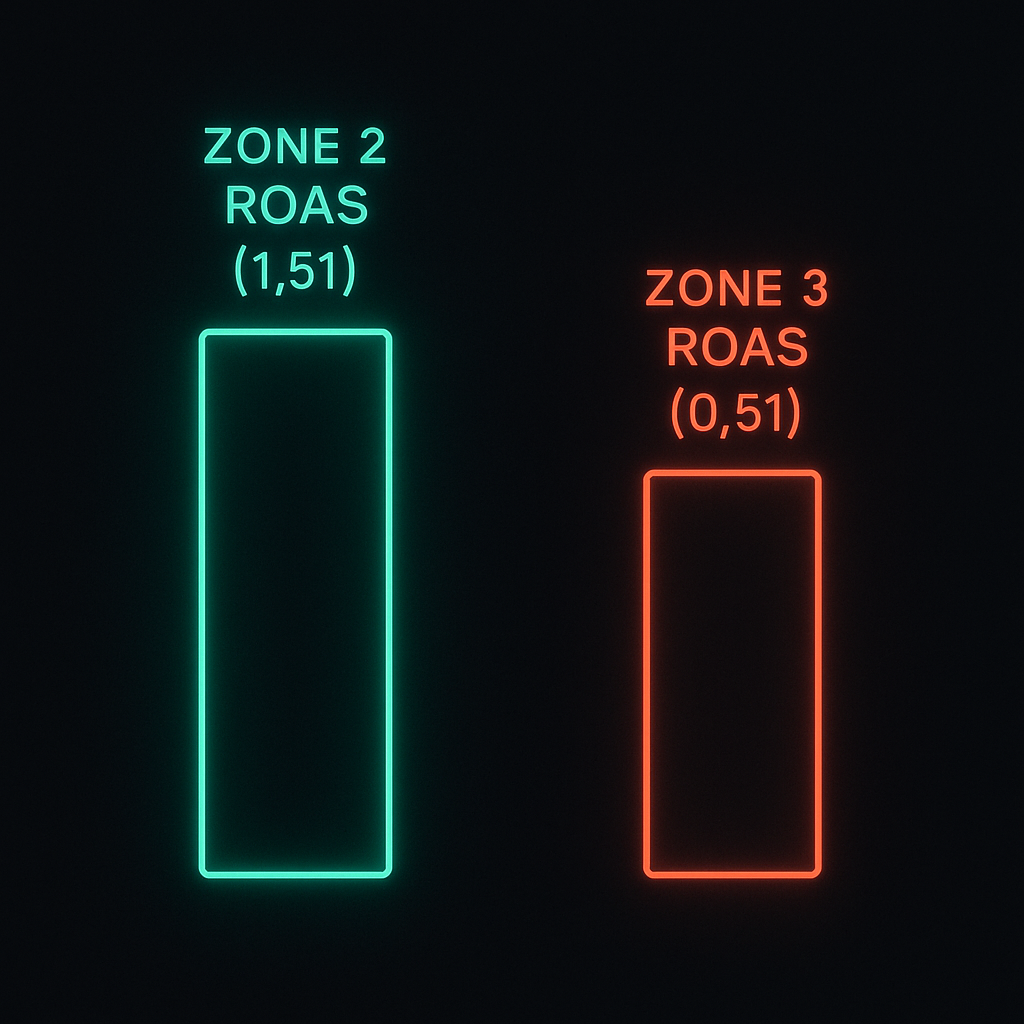

| Metric | Zone 3 (Brazil/Nigeria) | Zone 2 (Poland/Malaysia) |

|---|---|---|

| Visitors | 24,100 | 4,800 |

| Add to Carts | 840 (3.4%) | 290 (6.0%) |

| Purchases | 48 | 70 |

| Conversion Rate | 0.19% | 1.45% |

| Revenue | $1,296 | $1,890 |

| ROAS | 0.51 (Loss) | 1.51 (Profit) |

The Verdict: The “Expensive” traffic was profitable. The “Cheap” traffic lost money.

The Autopsy: Why Did Zone 3 Fail?

We analyzed the user session recordings (using Microsoft Clarity) to understand why 24,000 visitors failed to convert. We found two critical bottlenecks.

1. The “Payment Friction” Wall

This is the hidden killer of global marketing. In Brazil, 32% of users abandoned checkout because we only offered ‘Credit Card’. According to EBANX’s 2025 Payment Report, the Pix instant payment system now processes over 8 billion transactions monthly, outpacing credit cards as Brazil’s dominant e-commerce payment method. If you don’t offer Pix, you are invisible to 40% of the market.

They wanted to buy, but our infrastructure wouldn’t let them. In Nigeria, our Stripe account automatically flagged 40% of attempted transactions as “High Risk” and declined them, despite the users having valid funds.

2. The Trust Gap

Zone 2 users (Poland, UAE) behave like Tier 1 users. They see a secure checkout, they trust it. Zone 3 users are mobile-first and wary of scams. Our standard “Western-style” checkout page looked foreign to an Indonesian user used to buying on Shopee or Tokopedia.

Pro-Tip: The “Local” Trust Signal

When targeting Zone 3, do not use a generic currency converter that shows “$27 USD.” Use a dynamic pricing tool to display the price in local currency (e.g., “R$ 150”).

Action: If you are on Shopify, enable “Shopify Markets.” If you are on WordPress, use a plugin like Price Based on Country for WooCommerce. Seeing a familiar currency symbol increases conversion rate by ~40% in LATAM.

How to Make Zone 3 Profitable (The Fix)

Does this mean you should ignore Zone 3? No. It means you cannot treat Zone 3 like Zone 1.

If we ran this experiment again (which we will), here is the “Cyanide Protocol” we would use to flip that 0.51 ROAS into a 3.0+ ROAS:

- Switch the Payment Stack: Stop using standard Stripe. Switch to a Merchant of Record (MoR) like Paddle or Lemon Squeezy. They have local entities that accept local payment methods (Pix, Boleto, Alipay) natively.

- Filter by Device: The majority of our Zone 3 “bounce traffic” came from low-end Android devices. The GSMA Mobile Economy Sub-Saharan Africa 2024 Report confirms that while smartphone penetration is growing, a significant portion of the user base still relies on older 3G devices or entry-level smartphones that struggle with heavy, JavaScript-loaded US checkout pages.

- Fix: In Meta Ads Manager, check the box: “Target only users on Wi-Fi” and filter for “Android 12.0 and above” or “iOS devices.” This removes the lowest income demographic who literally cannot afford the product.

- Lower the Price (PPP): A $27 product is “Impulse Buy” in the US. In Vietnam, that is a significant purchase. Using Purchasing Power Parity (PPP), we should have priced it at $12. The World Bank’s PPP Conversion Factor data indicates that currency power in markets like Vietnam or Nigeria is drastically different from the US dollar. A $27 product in Nigeria feels like a $150 purchase to a local user, killing conversion rates instantly.

Conclusion: Choose Your Battlefield

- The “Lazy” Path: If you want to run standard ads with a standard US Stripe account, stick to Zone 2 (Poland, Malaysia, UAE). You will pay more for clicks ($0.50 – $0.80), but the math works out of the box.

- The “Scale” Path: If you are willing to set up local payments and device filtering, Zone 3 (Brazil, India) offers infinite scale.

Your Next Move:

- Check the current ad prices for these regions in our Global Ad Cost Index 2026.

- Run the numbers for your specific product margin using our CPM vs. CPC Profit Calculator.